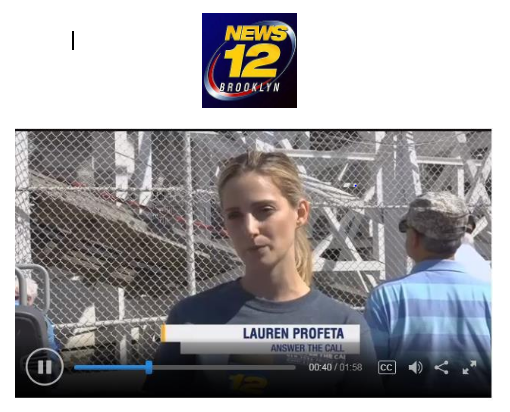

What will your legacy be? Would you like to join our Legacy Circle and make a gift that continues beyond your lifetime?

The Legacy Circle honors those who remember the families of our fallen first responders by including our organization in their will or estate planning. Legacy gifts help ensure we can continue to support our families for many decades to come. These gifts are important and valuable investments in the future of our families.

If you have already made a gift to our organization in your will or estate plan, we would like to hear from you and express our gratitude by including you in The Legacy Circle. There are no gift minimums or additional commitments for membership in The Legacy Circle. We simply would like to recognize your generous intentions and invite you to participate in upcoming events!

If you have not yet considered making a planned gift to our organization, take a moment to learn more about this opportunity.

- Did you know that making a planned gift to a charitable organization could have significant estate tax benefits?

- Did you know that a planned gift may be changed during your lifetime to ensure flexibility and accommodate any change in circumstances?

- Did you know that you can easily make a planned gift to our organization by making a bequest in your will or naming our organization as the beneficiary for your retirement or life insurance plan?

Below is sample language that could be used to make an unrestricted gift through a bequest in your will or codicil to your will:

Please note that the New York Police & Fire Widows’ & Children’s Benefit Fund is a 501(c)(3) non-profit organization and does not render legal or tax advice, and the information contained on this page should not be regarded as such.